What’s inside this article: A list of the best budget tracking apps to help you track, manage, and grow your finances.. Includes an overview of their features and pricing

With the cost of living constantly rising, more people than ever before are living paycheck-to-paycheck, and it’s straining many households across the country.

This makes it more important than ever to create and follow a budget to track and manage your finances to maximize your savings and financially prepare for the future. These are all essential for financial wellness.

One way to do this is with the help of a budget tracker app. These apps help you budget based on different budgeting strategies and come with a wide range of features. Continue reading to learn more about some of the best budget tracking apps, and find the one that best suits your needs.

Best Budget Tracking Apps

Budget tracking apps help you quickly see how much money you have on hand, track how much you’re spending and what you’re spending your money on, and view account balances for all your accounts in one place.

They help you analyze and visualize your spending habits, and reputable budget tracking apps are safe and secure to have your accounts linked to. Some also allow you to monitor your credit score so that you can keep an eye out for identity theft, too.

The best budget tracking app will depend on what features you need, so here’s a look at some of the most popular apps to help you make your choice.

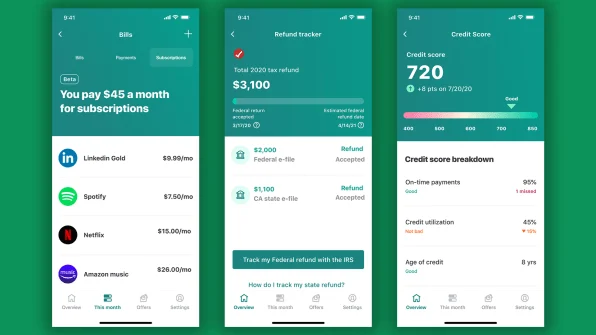

Mint

Mint is one of the best budget tracking apps if you’re looking for something easy to use yet comprehensive.

It’s free and helps you view all your finances in one place. Mint allows you to set and track savings goals and budget plans inside the app. You can also use this app to create easy-to-read reports that are tailored to your budgeting goals.

Mint calculates your net worth, credit debt, and investments and summarizes your monthly cash flow in real time. You can also check your credit score for free, and the app provides tips on how to improve it. Mint will also look for and suggest possible ways for you to save money.

You Need a Budget (YNAB)

You’ve probably heard of YNAB; it’s one of the more popular and comprehensive budget tracking apps out there. It helps you stay on top of your finances by following a “Zero-based” budgeting system.

It also offers personalized tutorials, so users can learn how to manage their finances according to their income and expenses.

One unique feature of YNAB is their loan calculator, which tracks interest saved with every dollar put towards your debt, motivating you to pay off your debt faster and smarter.

You Need a Budget costs $99/year; however, they offer a 34-day free trial. Having the trial for more than a month allows you to experience all the app’s features for the full month rather than having it expire on the last day before you can create and view reports. Plus, you don’t need to provide payment info when you sign up.

The average YNAB user Saves $600 in 2 months and $6000 in their first year.

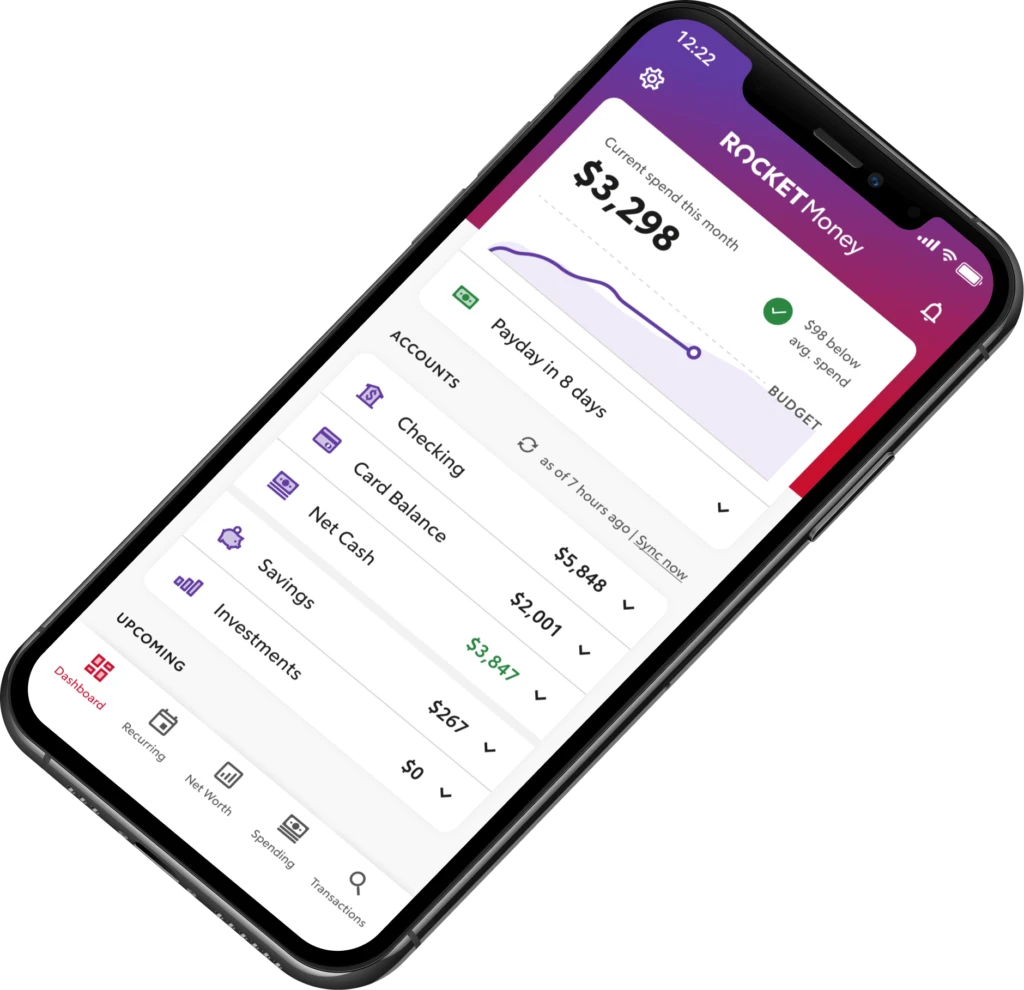

Rocket

Rocket is a budget tracking app designed to help you better understand your finances and make better financial decisions based on your spending patterns.

It syncs with your bank accounts, credit cards, and financial institutions to provide detailed overviews of all of your account balances and transactions in one place. The automation tool helps you quickly identify subscriptions they’re no longer using, and you can even cancel those subscriptions directly in the app.

Another awesome feature of Rocket is its bill negotiation tool. They will negotiate monthly rates with your service providers for you, which can save you hundreds of dollars every year, and you can sit back and let Rocket do all the work.

Rocket has a free and a premium version. They allow members to choose their own price for Premium. You can choose on a sliding scale between $3-$12/month, so you can choose the price that works for your financial situation.

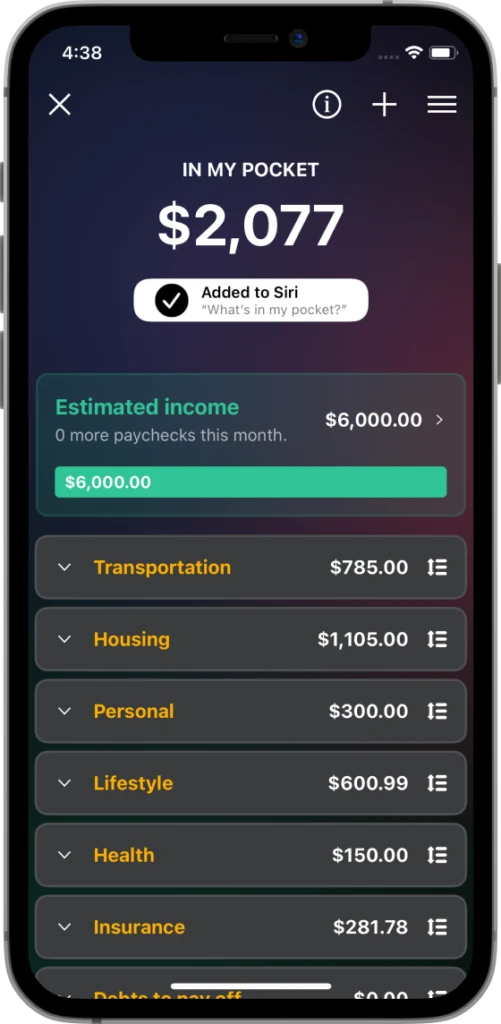

PocketGuard

PocketGuard is a budgeting app designed to help you take control of your finances. Like other budgeting apps, you connect to your bank accounts, credit cards, and other financial institutions to track and view all of your finances in one place.

Pocketguard’s “IN MY POCKET” feature shows you exactly how much disposable income you have after paying your bills, saving for your goals, and setting aside enough money for essentials like food & transportation.

It’s considered the best budget tracking app for overspenders.

This app also helps you plan effectively to pay off your debt using two popular strategies. Then it tracks and shows you how many payment cycles are left until you’re debt-free.

The feature is based on patterns known as “avalanche” – the highest interest first, and “snowball” – the highest debt first.

PocketGuard will track payments on all specified debts, keep your payoff plan up to date, and provide you with tips based on your budget and financial health.

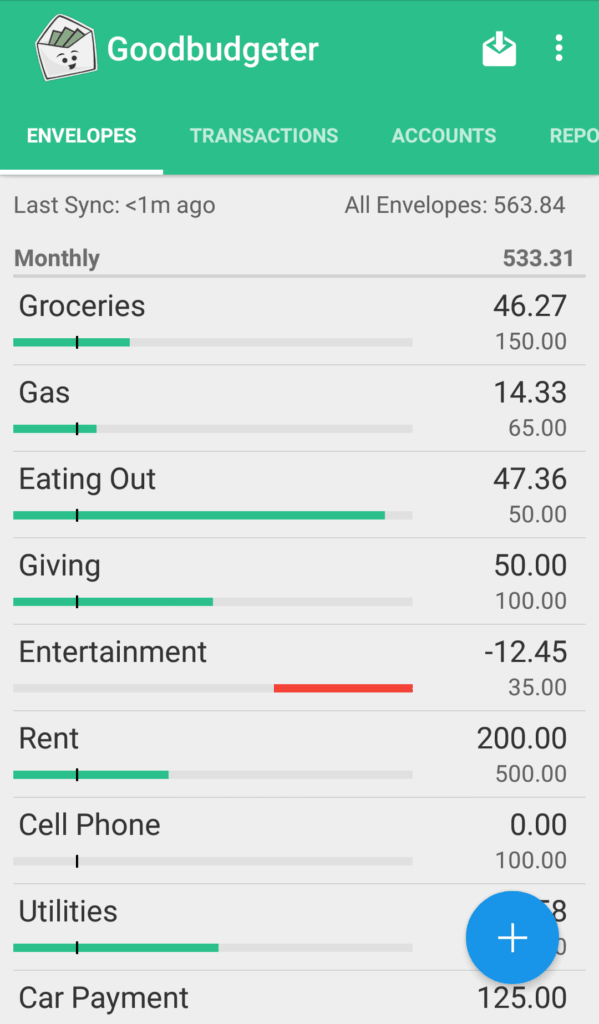

Goodbudget

Goodbudget is for people who want to do for hands-on envelope budgeting. This app allows you to plan and track your spending using Dave Ramsey’s envelop budgeting system.

This is one of the best budget tracking apps for you if you don’t want to link your bank accounts but want an app to help you plan and monitor your spending. You can input your balances manually and then create and assign amounts to envelopes following a tried and true budgeting system.

Goodbuget offers both a free plan and a premium plan with unlimited envelopes for $8 per month.

Honeydue

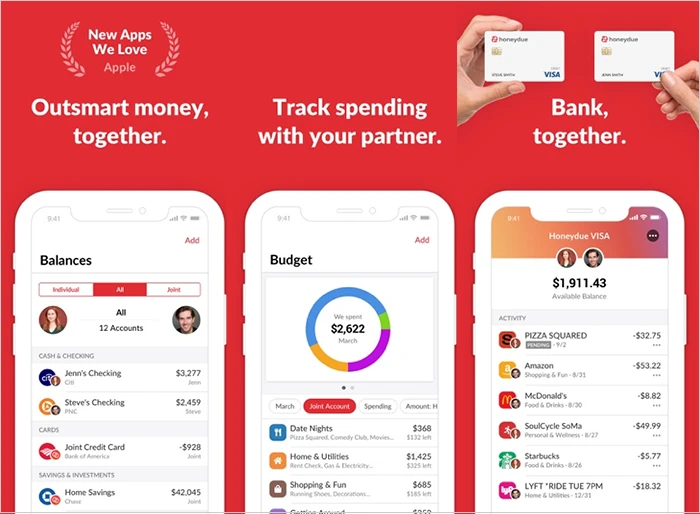

Honeydue is the best budgeting app for budgeting with your spouse. Its built for couples who want a joint budgeting app to help manage their finances together.

It allows both of you to link accounts, credit cards, loans, and investments in the same app to get a clear picture of both of your finances. You can even decide how much information you share with your partner.

You can set shared monthly spending limits for each category in the app, so neither of you unintentionally exceed your shared spending limit because you’re using separate bank accounts.

Other helpful features include reminders for upcoming bills, basic expense tracking, and an in-app chat feature for staying on top of finances with your partner.

Deciding on the best budget tracking apps for you can feel overwhelming. Hopefully, after reading this list, you have a better idea of which app will meet your needs without having to download and try them all out until you get lucky.